How to Use FBR Digital Invoicing System 2025 – Step-by-Step Guide for Businesses

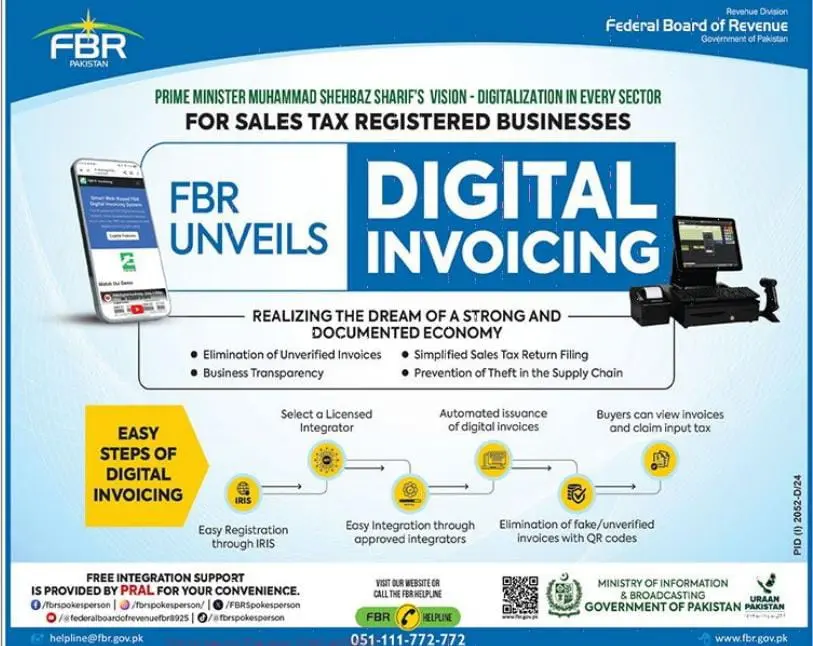

How to Use FBR Digital Invoicing System 2025 is a simple and step-by-step process launched by the Federal Board of Revenue (FBR) for sales tax–registered businesses. The system has been designed to eliminate fake invoices, bring transparency, prevent tax evasion, and make return filing easier for all registered businesses in Pakistan.

In 2025, the Federal Board of Revenue (FBR) of Pakistan introduced the Digital Invoicing System to modernize tax collection and ensure transparency. This new invoicing method replaces manual and unverified invoices with secure, digitally generated documents. Each invoice is integrated with the FBR server and comes with a unique QR code, which buyers and FBR can verify in real time.

For businesses, this system is not just about compliance—it also makes tax filing easier, prevents fraud, and builds trust with customers. In this blog, we will explain how to use the FBR Digital Invoicing System 2025 step by step, along with benefits, requirements, and best practices.

What is the FBR Digital Invoicing System?

The FBR Digital Invoicing System 2025 is a real-time electronic invoicing mechanism. Whenever a business records a sale, the system automatically generates an invoice that is reported to the FBR database. Customers receive invoices with QR codes that can be scanned for verification.

This process eliminates the use of fake or duplicate invoices and helps the government track genuine business activity. The system also reduces errors in tax filing by ensuring every transaction is properly documented.

Why Businesses Need Digital Invoicing in 2025

Businesses in Pakistan must adopt this system for several important reasons:

- Legal Requirement – FBR has made it mandatory for sales tax registered businesses in selected sectors.

- Customer Trust – Buyers prefer businesses that provide verifiable digital invoices.

- Transparency – Helps create a documented economy by reducing tax evasion.

- Ease of Filing – Digital invoices are automatically recorded, making monthly returns easier.

- Competitive Advantage – Early adopters gain credibility and customer confidence.

Check Also: FBR Online Invoicing System

Eligibility for Using the Digital Invoicing System

Not every business is required to adopt the system immediately. The main eligibility rules are:

- Sales Tax Registered Businesses – All registered under the Sales Tax Act must comply.

- Specific Sectors – Retail, wholesale, manufacturing, and service providers notified by FBR.

- High Turnover Companies – Large-scale businesses are prioritized for early integration.

- Voluntary Registration – Small and medium enterprises (SMEs) may join voluntarily to enjoy benefits.

Step-by-Step Guide: How to Use FBR Digital Invoicing System 2025

Here is the detailed process for businesses to start using the system:

Step 1 – Register on the IRIS Portal

- Visit the official FBR IRIS Portal.

- Log in using your Sales Tax Registration Number (STRN) and password.

- Select Digital Invoicing System from the menu.

Step 2 – Apply for Digital Invoicing Access

- Fill in your business details including NTN, STRN, sector, and address.

- Submit the application for approval.

Step 3 – Select an Approved Integrator

- Choose a licensed FBR-approved integrator for system setup.

- Integrators provide software for POS (Point-of-Sale) or ERP (Enterprise Resource Planning) systems.

Step 4 – Integrate POS/ERP with FBR Server

- Businesses with POS or ERP connect their systems directly with FBR servers.

- Integration ensures all invoices are transmitted automatically.

Step 5 – Generate Digital Invoices

- Once integrated, your system will automatically generate invoices for every sale.

- Each invoice carries a unique QR code for verification.

Step 6 – Verification by Customers

- Customers can scan the QR code using FBR’s mobile app or online portal.

- Verified invoices increase customer trust and allow input tax claims.

Features of FBR Digital Invoicing 2025

- Real-Time Reporting – Every invoice is sent directly to FBR.

- Unique Invoice Number – Prevents duplication and fraud.

- QR Code Verification – Easy for buyers to confirm authenticity.

- Integration with Returns – Automated data for monthly tax filing.

- PRAL Support – Technical support for integration at no extra cost.

How Customers Verify Invoices

The system is not only for businesses but also for customers. Buyers can verify invoices in three ways:

- QR Code Scanning – Use a smartphone to scan the code printed on the invoice.

- FBR Online Verification Portal – Enter invoice number and details to confirm authenticity.

- FBR Mobile App – Provides quick verification and invoice details.

This ensures transparency and reduces chances of fraud.

Read More: Raksh Tez Raftar 1800Watt Electric Rickshaw Price in Pakistan 2025

Requirements for Using the System

Before using the digital invoicing system, businesses must have:

- Sales Tax Registration (mandatory).

- Active NTN (National Tax Number).

- Registered Business Bank Account.

- POS or ERP Billing System.

- Stable Internet Connection for real-time reporting.

Benefits of Using FBR Digital Invoicing System 2025

Businesses adopting this system enjoy several advantages:

- Eliminates Fake Invoices – Every transaction is documented.

- Simplifies Tax Filing – No need for manual entry of sales data.

- Customer Confidence – QR verification builds trust.

- Government Support – Free integration via PRAL.

- Time & Cost Savings – Automation reduces paperwork and errors.

Challenges for Businesses

While the system is highly beneficial, businesses may face some challenges initially:

- Integration Costs – Upgrading POS or ERP may require investment.

- Training – Staff must learn how to issue and verify digital invoices.

- Internet Reliability – Weak connectivity in rural areas may create delays.

- Resistance to Change – Some businesses may be hesitant to shift from manual invoicing.

However, FBR and PRAL are working to minimize these challenges through free support and training sessions.

Future of Digital Invoicing in Pakistan

By 2025, Pakistan is moving towards a cashless and documented economy. The FBR Digital Invoicing System will play a key role in reducing corruption, improving tax collection, and strengthening the economy.

As more businesses adopt this system, transparency will increase, customers will feel more secure, and Pakistan’s tax system will become more efficient.

How to Use FBR Digital Invoicing System 2025 FAQs:

Q1: How can I register for FBR Digital Invoicing 2025?

You can register online through the FBR IRIS portal by applying under the “Digital Invoicing System.”

Q2: Do I need a POS system for digital invoicing?

Yes, businesses must have POS or ERP software integrated with FBR.

Q3: Is there a fee for registration?

No, registration is free, but integration costs depend on your POS/ERP setup.

Q4: Can customers verify invoices easily?

Yes, by scanning the QR code or using the FBR app/website.

Q5: Is digital invoicing mandatory for all businesses in 2025?

It is mandatory for sales tax registered businesses in notified sectors. Others may join voluntarily.

Conclusion

The FBR Digital Invoicing System 2025 is a game-changer for businesses in Pakistan. It not only fulfills legal requirements but also creates trust between businesses, customers, and the government. By following the How to Use FBR Digital Invoicing System 2025 step-by-step guide outlined above, companies can easily register, integrate, and start issuing digital invoices.

Adopting this system ensures compliance, simplifies tax filing, and contributes to a transparent economy. If you are a sales tax registered business, now is the time to switch to FBR Digital Invoicing 2025 and secure your future in Pakistan’s digital economy.

How to Use FBR Digital Invoicing System 2025