FBR Online Invoicing System 2025 Registration, Integration & Benefits for Businesses

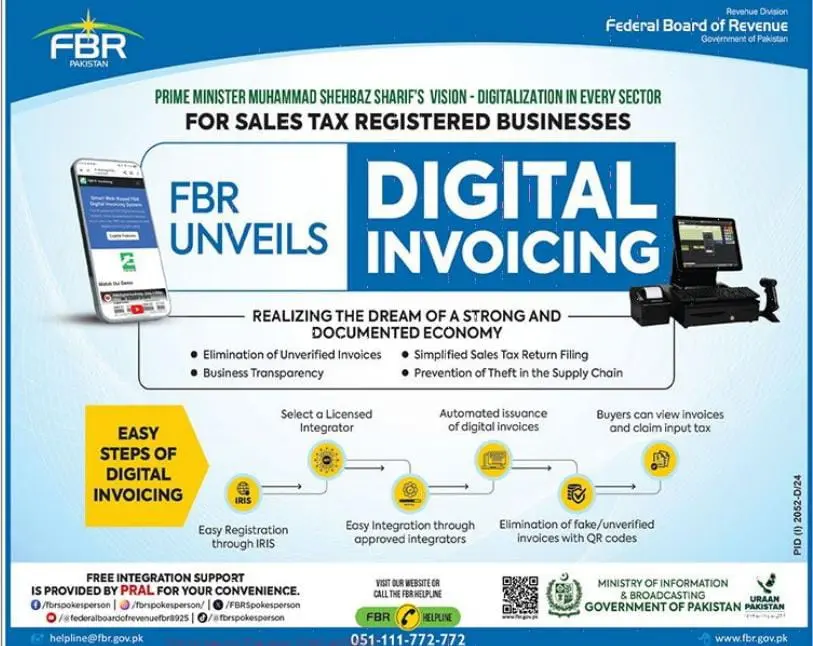

FBR Online Invoicing System is moving toward modernization, and one of the biggest steps is the introduction of FBR Digital Invoicing for sales tax–registered businesses. This reform, part of Prime Minister Shehbaz Sharif’s vision, aims to eliminate fake invoices, simplify tax filing, and ensure business transparency.

What is FBR Digital Invoicing System?

The digital invoicing system in Pakistan means invoices are created electronically instead of on paper. Each invoice carries a QR code for verification, making it impossible to use fake or unverified invoices.

Why Digital Invoicing is Important for Pakistan’s Economy 2025:

Pakistan’s economy has suffered from tax evasion and undocumented transactions. The FBR Online Invoicing System ensures that:

- Sales tax returns are simplified

- Fake invoices are eliminated

- Buyers can verify invoices online

- The supply chain becomes transparent

Key Benefits of FBR Digital Invoicing for Businesses 2025:

1. Elimination of Fake and Unverified Invoices

Invoices generated with FBR QR codes cannot be faked, ensuring authenticity.

2. Transparency in Business and Sales Tax Returns

All transactions are recorded electronically, making sales tax filing in Pakistan much easier.

3. Prevention of Supply Chain Fraud

Every step of the supply chain is tracked digitally, reducing theft and manipulation.

4. Buyer Protection and Easy Input Tax Claims

Buyers can verify invoices online and claim input tax without difficulty.

5. Automation Saves Time and Costs

Digital invoices reduce paperwork, saving time and money for businesses.

How to Register for FBR Digital Invoicing 2025:

Step 1: IRIS Online Registration

Businesses must register through FBR IRIS portal for e-invoicing.

Step 2: Select a Licensed Integrator

Choose an FBR Online Invoicing System to connect your business with the system.

Step 3: Integration with PRAL Support

PRAL (Pakistan Revenue Automation Ltd.) provides free integration support for smooth setup.

Government Support for E-Invoicing in Pakistan 2025:

- 📞 FBR Helpline: 051-111-772-772

- 📧 Email: helpline@fbr.gov.pk

- 🌍 Website: www.fbr.gov.pk

Impact of Digital Invoicing on Pakistan’s Tax System 2025:

- Better tax collection through elimination of fake invoices

- Fair competition for honest businesses

- Increased foreign investment due to transparency

- Ease of doing business with automation and less paperwork

Challenges in Implementing Digital Invoicing and Solutions 2025:

- Small businesses may struggle with technology → training and awareness sessions

- Fear of change → gradual implementation

- Technical issues → PRAL’s free technical support

Conclusion: FBR E-Invoicing for a Strong and Documented Economy 2025:

The FBR Online Invoicing System is a milestone toward transparency and fairness. It helps businesses, buyers, and the government equally by making the tax system more reliable and documented.

FAQs about FBR Online Invoicing System 2025:

1. What is FBR Digital Invoicing?

It is an online system for sales tax–registered businesses to issue invoices with QR codes, recorded directly in FBR’s system.

2. Who needs to use it?

All sales tax–registered businesses in Pakistan must adopt it.

3. How can businesses register?

Through the IRIS online portal and integration with an approved service provider.

4. What is PRAL’s role?

PRAL offers free integration support for businesses.

5. How do buyers benefit?

Buyers can verify invoices with QR codes and claim input tax credit easily.

6. What happens if a business does not comply?

Non-compliance may result in penalties or disallowance of tax credits.

7. How does this help Pakistan’s economy?

It strengthens tax collection, promotes fair competition, and improves transparency.

FBR Online Invoicing System 2025: